Details …

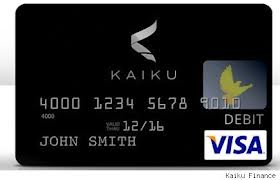

KAIKU cardholders pay a monthly fee of only $1.95 and access their money at more than 43,000 ATM’s worldwide (through the world’s largest surcharge-free ATM Network). Prepaid cards allow you to load (and reload) set amounts into your account. Once loaded, you can spend these funds like you would from a debit or credit card. The perk of using a prepaid card is you do not run the risk of overspending and incurring high overdraft fees (debit cards) or interest rates (credit cards.)

Our Thoughts …

We are fans of prepaid credit cards as gifts. We have also found prepaid cards to be great for travel because then we aren’t using our debit card or credit card in places we don’t normally go to. The biggest advantage we have found to prepaid cards is that we can give ourselves a budget for a trip or for shopping and we know we will stick to it during that time. As we have been working to pay off our credit cards, we try to put them away and not use them. Of course there are times like that car repair that came up last week that we do use those credit cards but on a daily basis, we don’t need to be carrying those credit cards in our wallets.

The KAIKU Visa Prepaid Card does not have a withdrawal fee. This is great for travel when we can’t find out bank and don’t want to get stuck with high fees. We are thankful that our bank is in a lot of states near here but it doesn’t take us too far to not find a branch and leaving us with ATM fees if we didn’t grab cash before we left on travel.

Plus since the KAIKU card works like a credit or debit card we can use it all of the places we would normally use our debit card such as the gas station … who wants to drag kids out of the van to run in and pay cash?! I love that we don’t have to think about “can we use this here?” when using the KAIKU card.

Would the KAIKU card be a good money management tool in your life? Leave us a comment and let us know!

I have received prepaid visa cards in the past as gifts and do like the versatility of it. I like the idea of using it as a means to budget to yourself. The one thing that confuses me ismthe monthly fee vs. activation fee. The ones i have received say 4.95 activation and onceu use the money up, its done. I guess this debit card allows u to reload and use continuoulsy at 1.95 per month